Best retirement age in Australia

In Australia, there is no rule or retirement age that must be reached before retirement is permitted.

Depending on your birth year, the age at which you are allowed to begin withdrawing your superannuation from the government is called your “conservation age,” and it ranges from 55 to 60.

In the event that you qualify for the Retirement Benefits, the amount you receive will be based on your income and asset worth. The questions, “When may I retire?” and “What age am I permitted to retire?” is often asked in Australia.

Since there is no mandatory retirement age or legislation in Australia, you are free to retire or reduce your hours of employment whenever you see fit. Even though most of us would want to retire young, most Australians are limited in doing so by two age limits that govern the availability of assets to support their golden years. These\sare:

This is the earliest age (barring exceptional circumstances) at which you may begin withdrawing from your retirement fund. To receive Australian Retirement Benefits, a person must reach the age of pension entitlement and complete all other eligibility requirements, such as being a permanent resident of Australia and meeting the income and asset tests.

Protecting your age and getting to your retirement

The purpose of your super is to provide for your pension. In most cases, you won’t be able to access your super until you reach your “preservation age,” which is anywhere from 55 to 60 years old. 1 The following table can assist you in determining your age of conservation and protection:

| Date of birth | Preservation age |

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – 30 June 1962 | 57 |

| 1 July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| From 1 July 1964 | 60 |

However, although you will be able to access a portion of your super after you reach your preservation age, you will not have complete access to your super until you have satisfied a condition of release.

The Super Release Requirements

When you reach your conservation age, you may begin drawing an income from your retirement account even if you are still working. However, a precondition of release must be satisfied before a retiree may take a lump sum distribution from their retirement account. You may withdraw your superannuation in one lump amount if you meet the following conditions:

Having reached your retirement age and preserving your life

Assuming retirement at 60 and leaving the workforce.

To reach the age of 65 (whether or not you have retired).

Withdrawing your superannuation funds early is possible in some exceptional circumstances.

Cashing in on your retirement savings (TTR)

If you’ve achieved conservation age but aren’t quite ready to retire completely and don’t meet a condition of releasing applications supported to lump sums, you may still get a part of your super via a transitioning to retirement benefits (TTR).

In the case of a TTR, your retirement income will come from your retirement savings account. You may retain your current work schedule while saving money on taxes with the aid of a TTR as part of your retirement plan, or you can use the extra time to pursue other interests.

However, with a TTR in place, you are limited to withdrawing between 2% and 10% of your super funds each fiscal year.

Consult a financial advisor before committing to this plan to ensure it’s the best option for you. Our website also contains information on a pension for the period between working and retiring.

The Age Pension eligibility criteria are as follows.

You must have attained your pension age, passed an income test, and passed an assets test, among other conditions, to receive a full or partial Age Pension from the government.

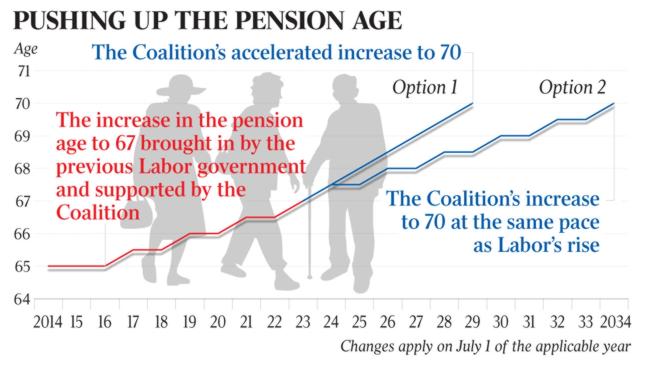

The current policy is to raise the age requirement for receiving a pension from the government by six months every two years, until it reaches 67 on July 1, 2023. Although the standard retirement age is 67, yours may be lower.

Whether you are single or married, how much money you make, and how much your assets are worth all affect how much of an Age Pension you would get. All qualified individuals receive the Age Pension’s base rate of pay in addition to the Pension Supplement and Energy Supplement.

The Age Pension eligibility and superannuation access ages are not the same for most people. You should see a financial advisor to learn more about your eligibility for the Age Pension since this benefit is also subject to an income test and an assets test.

In order to pass the income test, all of your revenue must be considered. The wealth test calculates how much money and property you have (excluding the home you live in). The ‘deeming’ principles are used to value financial assets, rather than the actual rate of return earned. Money in the bank, certificates of deposit, and stock are all examples of financial assets.

At what age do most Aussies hang it up?

The overall pension age for Australians is 55.4% based on data from the Australian Bureau of Statistics (ABS) If we look specifically at those who have retired within the previous five years, however, we find that the average retirement age for this group is really 63. 5

Australian birth average lifespan is also estimated on a regular basis by the ABS. According to the ABS’s most recent survey (conducted between 2016 and 2018), the average lifespan for a male birth is predicted to be 80.7 years, while a female infant may expect to live for 84.9 years. In addition, once you’ve reached 65, you still have one of the most significant life expectancies in the world; men may expect to live another 19.9 years and women another 22.6 years.